Özel bilgi ve zaman kaybı olmadan, hazır endeks portföylerini kullanarak büyüyen kripto para piyasasına yatırım yapmaya başlayın.

The potential of the Cryptocurrency Market

By comparing the capitalization of major financial markets we can see that the cryptocurrency market has great potential for possible growth. The total capitalization of the cryptocurrency market for 2024 is approximately $2.6 trillion. The top 30 cryptocurrencies account for approximately $2.27 trillion and about 80% of the entire market

The market has reached its current capitalization over the last ten years due to technological advancements and retail investor interest. However, ahead we can see the potential for even more significant growth due to:

- the introduction of statutory regulation;

- new investment from large investors and financial organizations;

- increased interest from retail investors;

- research and development of new services and technologies.

Even if 10 per cent of global capital enters the market, we will see a significant increase in cryptocurrency prices. As a result, the current capitalization of $2.6 trillion could exceed tens of trillions of dollars.

Comparison of cryptocurrency market capitalization to other financial markets

Why the cryptocurrency market has the potential to grow 50-100x by 2030

As we look to the future, many investors and analysts are wondering what the cryptocurrency market will look like in 2030.

One possible scenario is that cryptocurrencies will become more mainstream and widely accepted by both consumers and businesses. As cryptocurrencies become more integrated into our daily lives, we will see more uses for them, such as paying for goods and services, or getting paid in cryptocurrency.

Obviously, cryptocurrencies will continue to evolve and become more sophisticated, backed by new functionality and features that we can't yet imagine. For example, we are already seeing the development of a whole area of decentralized finance (DeFi) that will allow for more efficient and secure financial transactions. All of this is fueling growing interest from institutional and private investors. Many large financial institutions have already started investing in cryptocurrencies, which could help legitimize the market and attract even more investment in the future.

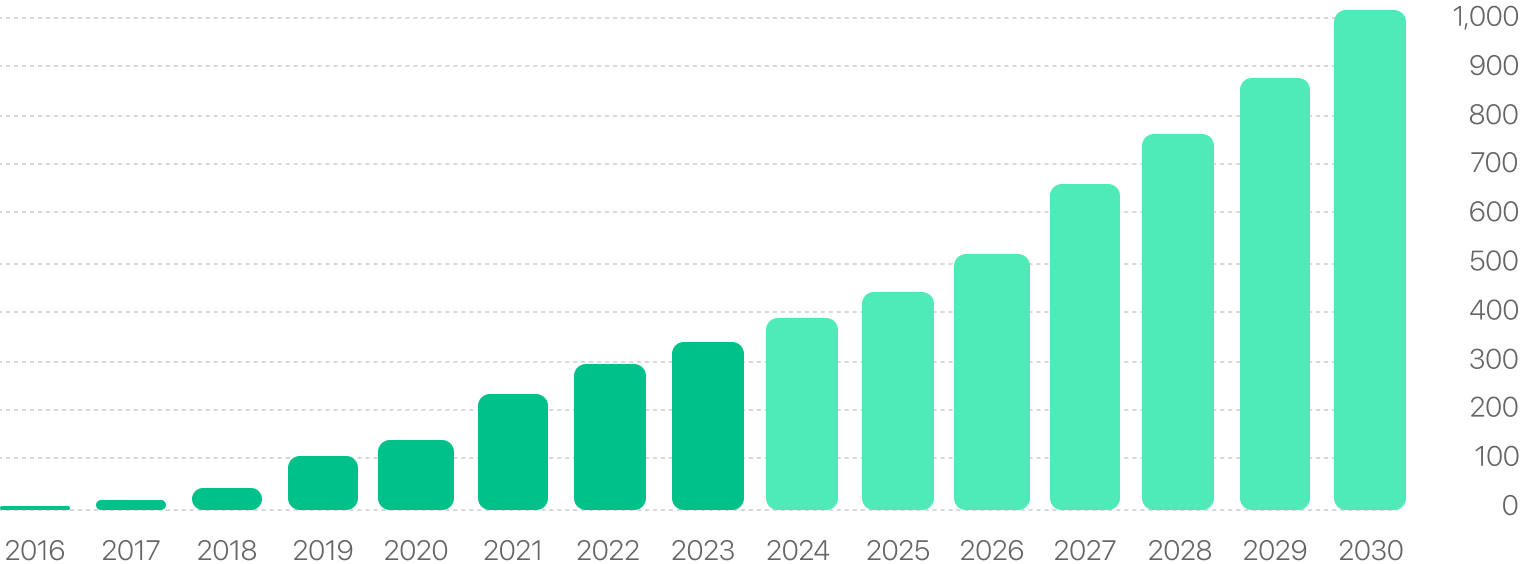

Number of cryptocurrency users in 2023, million

Why index investing is the best way to grow your capital in the cryptocurrency market

Investing in an index is more efficient than investing in individual cryptocurrencies for several reasons.

Firstly, investing in a market index reduces the risk to your investments and reduces the impact of any single event or news on your portfolio. This helps to minimize losses and increase the overall return and stability of your portfolio.

Secondly, investing in a market index does not come with high fees for managing your investment. This is because index investments do not require the same level of active management and research as individual stocks or cryptocurrencies.

As a result, investing in a market index reduces costs and mitigates risk, helping investors effectively achieve their financial goals over the long term.

Warren Buffett's bet, which we discussed in a previous article, is an irrefutable fact and a prime example of how effective a market index is as a tool for increasing savings.

See your growth potential

Over the past four years C 1.05.2020 to 1.05.2024, the J'JO 35 market index would have increased an investor's amount by 830% without any specialized knowledge or time spent analyzing market opportunities. The average annual growth rate over 4 years was 67%. This does not mean that this percentage of growth over the historical period can be taken as a forecast for the future. It merely reflects the dynamics of the market. If you understand the development potential of the cryptocurrency industry, then based on the historical market behavior you can make your own assumptions about the future market development.

*Hesap makinesi ve grafik, yatırımları etkileyebilecek olası ekonomik veya piyasa faktörlerini dikkate almaz. Sonuçlar yalnızca bilgi amaçlı sağlanmaktadır ve J'JO endeksleri ve portföyleri için yatırım tavsiyesi veya tahmin olarak değerlendirilmemelidir.

İstediğiniz zaman başlayabilirsiniz. Örneğin, hemen şimdi!

Kullanışlı ve basit bir hizmette kripto para birimlerine etkili yatırım yapmak için ihtiyacınız olan her şey.

Ücretsiz dene